The price of natural gas varies dramatically across the US. As such, the "insurance" provided by a Futures contract against the underlying price of natural gas is useful but incomplete. What is needed is a standard agreement which mitigates the second largest component of price risk - the uncertainty between the price at a given location and the price at the Henry Hub. Basis contracts address this component of price risk. A Basis contract is a contract based on the difference in price between a futures contract settlement and the market price of natural gas at a given location for the same delivery period.

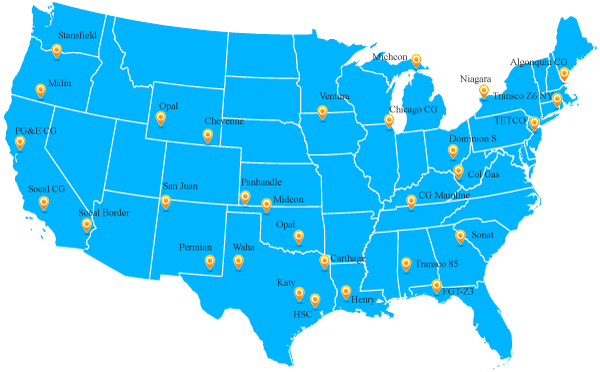

The underlying price of natural gas (at the Henry Hub location) is easily determined for each delivery period since related futures contracts are transparently traded on a commodity exchange. However, the market price of natural gas at other locations is not as easily determined. This causes issues - if two parties enter into a contract based on the market price of natural gas at a given location, neither party will be comfortable allowing the other party to define that location's market price. What is required is an independent third party to define the location's market price.There are a number of organizations operating in the US natural gas markets which publish market prices in the form of an index. Indices are price determinations provided by independent third parties for a given location and covering a given delivery period. For example, the average monthly price for a natural gas at the Houston Ship Channel is reported by S&P Global Platt's via it's "Houston ShipChl Mo" index. And the average daily price for natural gas at the Houston Ship Channel is reported by S&P Global Platt's via it's "Houston ShipChl FDt Com" index. S&P Global Platts determines it price for each published index using a published methodology (their "Methodology And Specifications Guide for North American Natural Gas") which involves surveying next month fixed price purchases and sales at each location during "bid week" to set the monthly index (an oversimplification) and next day fixed price purchases and sales at each location to set the daily index. Note that S&P Global Platt's does not necessarily publish both a monthly and a daily index for each location. Moreover, the number of locations for which indices are published is far less than the number of tradable locations. However, the covered locations are dispersed enough to allow for reasonable hedging of location price risk in most situations. In addition, although S&P Global Platt's is the de facto standard in the US for natural gas, other index providers (such as NGI, Argus, etc.) also publish natural gas indices and may have dominant positions in other locales or commodities.

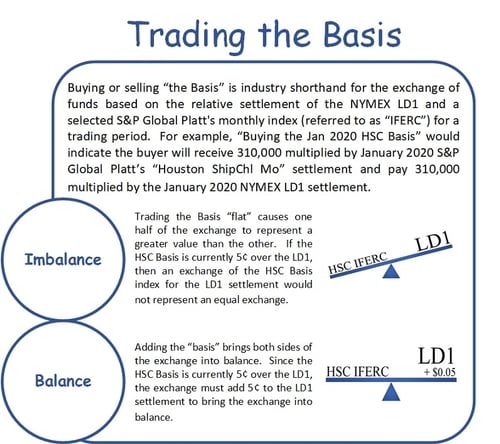

"Buying the Basis" and "Selling the Basis" are examples of industry short hand. "Trading the Basis" requires a bit more information in that a location is required. For example, a trader may choose to "Buy the Katy Basis". In which case, the trade would involve the trader receiving a cash payment based upon the relevant settlement of the S&P Global Platt's Katy IFERC index (specifically, S&P Global Platt's "Katy Mo" index) and making a cash payment based on the NYMEX futures contract.

Every honest transaction (in theory, at least) has a zero Mark-to-Market value for each party as of the time of the transaction. Since all honest transactions represent an equal exchange of market value, a basis transaction's mark-to-market value at the point of inception must be zero. As such, Basis contracts include an adjustment on the LD1 side of the transaction to bring the exchange into balance. In our example of "Buying the Katy Basis", the trader is long the S&P Global Platt's Katy Monthly index and short the NYMEX LD1 index. On any given day, the market will have an opinion on how the Katy index will settle relative to the LD1's settlement. That relative difference is applied to the LD1's price to bring the exchanged values into equivalence (e.g. "Buying the Katy Basis at $0.30").

Basis contracts are one of the most common natural gas derivatives in the US natural gas markets. Basis contracts allow parties to exchange the risk associated with basis locations by exchanging the price at a location for the price at the Henry Hub. Using a combination of Futures and Basis contracts, a party can reduce or remove all (or the majority) of their exposure to price movements.

In fact, using just these two agreements, each of the parties in our Price Risk examples can mitigate their risks. The industrial can buy natural gas futures contracts and basis contracts to convert their feedstock cost to a fixed price at their location, the retailer can either buy or sell basis contracts to convert their supply into a floating price or their sales into a fixed price, and the producer can sell futures and basis contracts to lock in the sales price at their location and therefore their revenue.

Next, let's take a quick look at a couple key termsm starting with PhysBasis.